新入荷再入荷

ナガノパープル ぶどう ブドウ 苗木 接木苗 特等苗 希少 ガーデニング

タイムセール

タイムセール

終了まで

00

00

00

999円以上お買上げで送料無料(※)

999円以上お買上げで代引き手数料無料

999円以上お買上げで代引き手数料無料

通販と店舗では販売価格や税表示が異なる場合がございます。また店頭ではすでに品切れの場合もございます。予めご了承ください。

商品詳細情報

| 管理番号 | 新品 :54928571 | 発売日 | 2025/01/03 | 定価 | 8,500円 | 型番 | 54928571 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

ナガノパープル ぶどう ブドウ 苗木 接木苗 特等苗 希少 ガーデニング

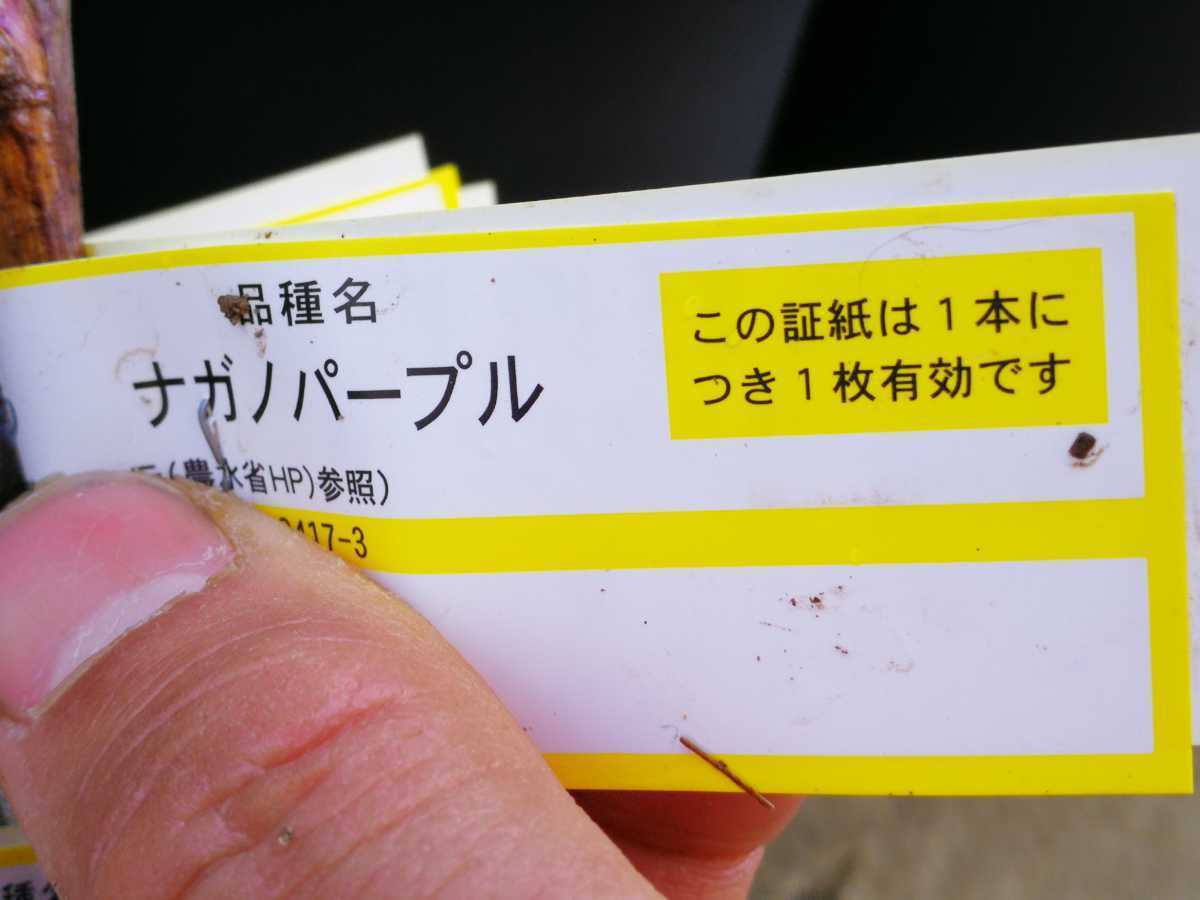

ナガノパープルぶどう苗木(接木苗・特等苗・希少苗)の出品です。1本のお値段です。複数希望の場合はお問い合わせください。

抜き苗で発送予定です。現在、保湿管理中です。

到着後、お早めに植えてください。

とても希少なナガノパープルの苗です。

7本を注文しましたが、栽培予定が変わりまして一部が余りました。そのため、余った分を出品させていただきました。

親は巨峰とリザマートです。

種がなく、皮まで食べられる、大粒の高級ぶどうです。

#巨峰

#マイハート

#マイハート苗

#ブドウ

#ぶどう

#シャインマスカット

#ナガノパープル

#シャインマスカット苗

#ナガノパープル苗

#ブドウ苗

#ぶどう苗

![Dell Precision Tower 3620 [i7-7700]](https://static.mercdn.net/item/detail/orig/photos/m70672640761_1.jpg?1650191888)